Genki World Insurance is a flexible travel insurance designed for digital nomads, long-term travelers, and expats. Unlike traditional providers, it offers worldwide coverage with no long-term contracts, making it ideal for those always on the move.

Backed by Allianz and Barmenia, Genki provides medical coverage, emergency care, and a simple claims process—all managed online. But is it really the best option for travelers? In this Genki Insurance review, we’ll break down its features, pros, and potential drawbacks to help you decide.

Why Choose Genki?

Genki World Insurance is built for travelers who don’t stay in one place for long. Unlike traditional insurance, it’s flexible, fully digital, and designed for nomads who need reliable coverage without the hassle. Here’s what sets this nomad health insurance apart:

- No Long-Term Contracts: Genki runs on a monthly subscription model, so you’re not locked into a long-term commitment. Cancel anytime without penalties.

- Worldwide Coverage: No matter your nationality or where you’re traveling, Genki covers you globally.

- Trusted Providers: Genki is backed by Allianz and Barmenia, which are established names in the insurance world and ensure reliable coverage.

- Fully Digital & Hassle-Free: No paperwork, no agents, no waiting in offices. Everything from sign-up to claims is managed entirely online.

- Designed for Nomads & Long-Term Travelers: Unlike standard travel insurance, Genki caters specifically to those on extended trips, whether you're hopping between countries or living abroad.

- Competitive Pricing: Traditional expat insurance can be expensive. Genki keeps costs lower while offering robust coverage tailored to frequent travelers.

Genki Travel Insurance Plans: Explorer vs. Native

Genki offers two distinct plans tailored to different types of travelers: Genki Explorer for short- to mid-term trips and Genki Native for those needing long-term, expat-level coverage, perfect for those looking for a digital nomad insurance.

Genki Explorer – Travel Health Insurance

Designed for short- to mid-term travelers (up to 2 years), this traditional travel insurance plan is ideal for digital nomads, backpackers, and remote workers who need reliable emergency medical coverage without long-term commitments. Here's our Explorer insurance review:

- Covers medical emergencies, accidents, and sudden illnesses worldwide.

- Includes hospital stays, outpatient treatments, and prescriptions.

- No deductible—Genki pays the bills directly (where possible).

- Works in almost every country, with full or limited coverage in the USA & Canada based on your selection.

- Subscription-based, so you can cancel anytime.

- Home country coverage: You must choose a home country where you have no visa restrictions and access to long-term health coverage (such as public healthcare or local health insurance). However, visits to friends and family in your home country are covered for up to 42 consecutive days within 180 days.

- Monthly cost: Pricing depends on the deductible and whether you include or exclude the USA & Canada.

Our verdict: this plan covers everything you'd need as a traveler at a very good starting price for the level of coverage included.

Genki Native – International Health Insurance

A comprehensive health insurance plan designed for long-term travelers, expats, and remote workers who need full-scale coverage beyond emergencies. Unlike Explorer, this plan is permanent health insurance with no time limits.

- Covers preventive care, dental, vision, chronic conditions, and maternity (Premium plan).

- Works worldwide, with limited coverage in Canada & USA unless selected.

- Lets you choose deductibles and coverage levels to fit your budget.

- Ideal for those living abroad long-term, not just passing through.

- Acts as a full replacement for national health insurance.

- Home country coverage: Available for people from every country, including those without legal residence. You can choose to have limited or full coverage in your country of citizenship.

- Monthly cost: Pricing depends on age, deductible, medical questionnaire results, and chosen region of coverage (incl. or excl. USA & Canada).

- Minimum contract: 1 year (with a monthly payment plan).

Plan options:

- Genki Native Basic: covers necessary medical treatment.

- Genki Native Premium: includes preventive care, dental, vision, maternity, and mental health. It also offers full coverage in your country of citizenship.

If you’re planning to live abroad indefinitely, Genki Native offers lifelong, comprehensive health coverage, not just travel protection.

Which One Should You Choose?

- For short- to mid-term travelers needing emergency medical coverage → Genki Explorer.

- For long-term travelers or expats needing full healthcare, including check-ups and chronic care → Genki Native.

What Makes Genki Insurance Different From Other Travel Insurance Providers?

Most travel insurance providers cater to short-term trips with rigid policies and limited flexibility. Genki takes a different approach, offering coverage that adapts to the lifestyle of digital nomads and long-term travelers. Here’s what sets it apart:

- Designed for Long-Term Travelers – Unlike standard travel insurance that assumes short vacations, Genki is built for digital nomads, expats, and remote workers who need reliable coverage for months or even years.

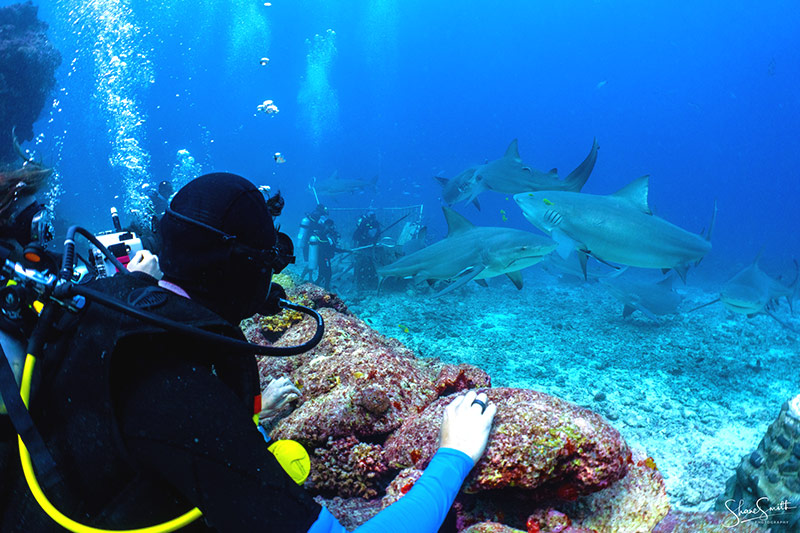

- Insurance for Adventure Sports – Many insurers exclude high-risk activities, but depending on the plan you choose, Genki covers a range of adventure sports like surfing, scuba diving, and skiing, ensuring nomads can pursue their passions without extra fees or add-ons.

- Flexible Coverage Areas – No fixed destinations. Whether you move between continents or settle in one place for a while, Genki adapts to your travel plans without geographic restrictions.

- Adaptable Subscription Plans – The Explorer plan operates on a simple monthly subscription, allowing travelers to stay covered for up to two years without long-term contracts.

- Broader Health Coverage – Covers everything from emergency medical care to hospitalization, surgeries, and prescription medications. The Native plan includes preventive care, chronic conditions, maternity, and dental.

- Efficient Claims Handling – No need for paperwork or endless calls. Genki’s fully digital claims process lets you submit documents online and once approved, reimbursement is processed quickly via bank transfer.

- No In-Network Restrictions – Visit any licensed doctor, hospital, or clinic worldwide without worrying about staying within a specific provider network.

- Straightforward Pricing & Transparency – No hidden fees or surprise exclusions. What you see is what you get, with clear terms and flexible pricing based on your chosen coverage level.

What Does Genki Cover?

Genki offers solid coverage for travelers, but the details depend on which plan you choose. Here’s a breakdown of what’s included and what’s not.

✅ Included Coverage:

Both Genki Explorer (short-term travel insurance) and Genki Native (long-term health insurance) cover essential medical needs, but Native provides more comprehensive benefits.

- Emergency Medical Treatments – sudden illnesses, injuries, and accidents.

- Hospitalization & Surgeries – hospital stays, surgeries, and specialist treatments.

- Doctor Visits & Outpatient Care – consultations, diagnostics, and outpatient treatments.

- Prescribed Medications – necessary prescriptions related to covered treatments.

- Evacuation & Repatriation – emergency transport to the nearest medical facility or back home if medically necessary.

- COVID-19 Coverage – Medical treatment for COVID-19, as long as it's not a pre-existing condition.

- Dental & Vision (Genki Native only) – check-ups, glasses, contacts, and necessary dental work.

- Maternity & Chronic Conditions (Genki Native only) – pregnancy-related care and long-term medical conditions.

❌ What’s NOT Covered? (Exclusions & Limitations)

Like all insurance plans, Genki has exclusions. Here’s what isn’t covered:

- Routine Check-ups – Not included in the Explorer plan (Native covers them).

- Pre-existing Conditions – Explorer does not cover any conditions you had before signing up.

- Extreme Sports – Some high-risk activities (for example: skydiving) require an extra add-on.

- Cosmetic Treatments – Anything non-medically necessary, like botox or plastic surgery, is excluded.

- Elective Surgeries – If it’s not an emergency or medically required, it’s not covered.

Table Summary:

| Coverage Type | Genki Explorer (Short-Mid Term) | Genki Native (Long-Term) |

|---|---|---|

| Medical Emergencies | ✅ Covered | ✅ Covered |

| Accidents & Injuries | ✅ Covered | ✅ Covered |

| Hospital Stays & Surgeries | ✅ Covered | ✅ Covered |

| Doctor Visits & Outpatient Care | ✅ Covered | ✅ Covered |

| Prescription Medications | ✅ Covered | ✅ Covered |

| Emergency Medical Evacuation | ✅ Covered | ✅ Covered |

| Preventive Care & Checkups | ❌ Not Covered | ✅ Covered |

| Dental Treatments | ❌ Not Covered | ✅ Covered |

| Vision Care (Glasses, Contacts) | ❌ Not Covered | ✅ Covered |

| Chronic Conditions Treatment | ❌ Not Covered | ✅ Covered |

| Maternity & Childbirth | ❌ Not Covered | ✅ Covered |

| Coverage Duration | Up to 2 years | No time limit (lifetime) |

| Flexibility | Monthly subscription, cancel anytime | Long-term plan, requires commitment |

| Best For | Digital nomads, backpackers, remote workers | Expats, long-term travelers, families |

How Much Does Genki Travel and Health Insurance Cost?

Your premium is based on a few key factors:

- Your Age – Pricing varies by age group, with younger travelers paying lower premiums and costs increasing for older age brackets.

- Regions of Cover – Choosing coverage that includes the U.S. and Canada increases the price due to higher healthcare costs in those countries. Excluding them lowers your monthly premium.

Pricing is customized based on age, coverage level, and deductible selection.

Plans start at a lower base rate but increase with add-ons like dental, vision, and maternity.

For exact rates, Genki provides a quick online quote based on your personal details, ensuring full transparency before you commit.

Genki Travel Insurance Review: Deductibles?

Let’s talk about something that’s not exactly thrilling but crucial to know—deductibles. This is the amount you pay out of pocket before your insurance kicks in. Understanding how deductibles work with Genki can help you avoid unexpected expenses.

Genki Explorer Deductibles: If you’re on the move, Genki Explorer keeps it simple with a fixed €50 deductible per claim. You cover the first €50, and Genki takes care of the rest—keeping costs low without major surprises.

Genki Native Deductibles: For long-term travelers and expats, Genki Native offers three deductible options:

- €1,000 Annual Deductible – You pay the first €1,000 of medical expenses each calendar year. After that, Genki covers everything.

- €500 Annual Deductible – A lower upfront cost than the €1,000 option, but with slightly higher monthly premiums.

- No Deductible – No out-of-pocket costs for covered treatments, but expect a higher monthly premium.

Choosing the right deductible depends on your budget and healthcare needs. If you prefer lower monthly payments, a higher deductible might be the better option.

How to Get Your Genki Travel Insurance

- 1️⃣ Visit the Genki Website: Head to their official site to start the process.

- 2️⃣ Choose Your Plan: Pick between Genki Explorer (for short- to mid-term travelers) or Genki Native (for long-term coverage).

- 3️⃣ Fill Out Basic Info: Enter your personal details. No health questionnaires or medical exams required.

- 4️⃣ Make Your Payment: Pay securely using a credit card or direct debit.

- 5️⃣ Get Instant Coverage: As soon as payment is processed, you’ll receive your confirmation and policy documents via email—no delays, no back-and-forth with agents.

How to Use Genki: Getting Medical Help

- 1️⃣ Visit Any Licensed Doctor or Hospital: Unlike many insurance providers, Genki has no network restrictions, so you can go to any certified healthcare provider worldwide.

- 2️⃣ Pay for Treatment Out of Pocket (in Most Cases): Unless direct billing is available, you’ll need to cover the cost upfront. Keep all receipts and medical reports.

- 3️⃣ Submit a Claim Online: Log into Genki’s digital platform, upload your receipts and medical documents, and submit your claim. No paperwork, no faxing, no phone calls.

- 4️⃣ Get Reimbursed via Bank Transfer: Once approved, Genki transfers the reimbursement directly to your bank account. Processing times vary depending on the claim and medical provider.

Pro Tip: Always ask for detailed receipts and medical reports at the time of treatment—missing documentation can delay reimbursement.

Lost Luggage Claim Process

- 1️⃣ Report the Loss to the Airline: As soon as you realize your luggage is missing, go to the airline’s baggage claim desk and file a Property Irregularity Report (PIR). This document is essential for your claim.

- 2️⃣ Notify Genki Within the Claim Timeframe: Every insurance provider has a deadline for reporting lost baggage claims. Make sure to inform Genki as soon as possible to stay within their required timeframe.

- 3️⃣ Gather & Submit Documentation: Provide all necessary paperwork, including: Property Irregularity Report (PIR) from the airline, Receipts for essential purchases (if you had to buy replacements), Proof of ownership (receipts or photos of lost valuables).

- 4️⃣ Wait for Processing & Reimbursement: Once your claim is reviewed and approved, Genki will reimburse you via bank transfer. Processing times may vary, so keep an eye on your email for updates.

Tip: The more documentation you provide upfront, the faster your claim will be processed.

Good to know: Always keep a few basics, essentials like extra pair of socks, underwear, t-shirt in your hand luggage. Check out more tips in our packing list.

Refund Process Explained

Genki offers a flexible cancellation policy, but refunds depend on when you cancel. Here’s how it works:

- Cancel Anytime Before the Next Billing Cycle: since Genki operates on a monthly subscription model, you can stop your coverage at any time, and you won’t be charged for the next month.

- No Refunds for Past Months: If you’ve already paid for a month, Genki doesn’t offer refunds for unused days or past coverage periods.

- Long-Term Plans May Have Different Rules: For Genki Native, which is a more traditional health insurance plan, cancellation policies may vary based on the terms selected at sign-up.

Genki Insurance Review: Trustworthy?

- Backed by Established Insurance Providers: Genki isn’t some fly-by-night operation; it’s backed by Allianz and Barmenia, two major insurance companies. This ensures financial stability and credibility.

- Used by Travelers Worldwide: Digital nomads, backpackers, and expats in multiple countries rely on Genki for coverage, and its user base continues to grow.

- Transparent Pricing & Policies: Unlike many insurers, Genki’s pricing is clear, and there are no hidden fees. What you see is what you pay.

- Claim Processing Times Can Vary: While some users report smooth reimbursements, others mention delays in claims being processed, especially for complex cases. This is common in the insurance industry but worth considering if you need fast payouts.

- Regulated Under German/EU Insurance Standards: Genki operates under strict European regulations, adding an extra layer of legitimacy and consumer protection.

So is Genki insurance legit? Yes.

Genki vs. SafetyWing & Others:

| Feature | Genki Explorer | Genki Native | SafetyWing | World Nomads | Cigna Global |

|---|---|---|---|---|---|

| Emergency Coverage | ✅ | ✅ | ✅ | ✅ | ✅ |

| Routine Care | ❌ | ✅ | ❌ | ❌ | ✅ |

| Pre-existing Conditions | ❌ | ✅ | ❌ | ❌ | ✅ |

| Trip Length Limit | 2 years | Unlimited | No limit | 6 months | Unlimited |

| Claims Process | Online | Online | Online | Online | Online |

We also wrote detailed article review on Heymondo insurance and Safetywing.

Strengths & Weaknesses of Genki

Like any insurance, Genki has its pros and cons. Here’s a breakdown of why people choose it—and where it could improve.

✅ Pros (Why People Choose Genki)

- Affordable for long-term travelers – Compared to traditional expat insurance, Genki offers budget-friendly pricing

- No contracts or hidden fees – Monthly subscription model means you’re not locked in and can cancel anytime.

- Covers travelers of all nationalities – No restrictions based on citizenship, making it ideal for global nomads.

- No in-network restrictions – Unlike some insurers, Genki lets you see any licensed doctor or hospital worldwide.

- COVID-19 coverage included – Medical expenses for COVID-related treatments are covered.

❌ Cons (Our Genki World Insurance Review Complaints)

- Reimbursement delays reported – Some users mention slow claim processing, especially for complex cases.

- Strict documentation requirements – If you don’t submit complete and detailed paperwork, your claim could get delayed or denied.

- Limited support channels – Fewer customer service options compared to bigger insurers like Cigna or Allianz.

- Explorer plan lacks routine/preventive care – If you need regular check-ups, you’ll have to pay out of pocket unless you're on Genki Native. These are our main Genki Explorer insurance complaints.

Hostelz.com is the world's most comprehensive hostel-focused travel platform. We bring together listings from all the major booking sites to help you easily compare prices, see real guest reviews, and find the best deals—no matter where you're headed. Check out our How It Works page.

Not sure which hostel to pick? Use our Hostel Comparizon Tool to compare your favorite hostels side-by-side before you book.

Let us help you travel smarter and sleep cheaper.

You are Overpaying for Hostels - that Stops now!

The same room can cost different prices on Hostelworld and Booking. 😱

Hostelz compares hostel prices for you. Save up to 23%.

Easily Compare Travel Insurance

Starting from $42/month

Starting from $50/month

Affordable and customizable

Compare 3 Hostels Side by Side

Not sure which hostel to pick? Use our Comparizon Tool to compare up to 3 hostels side-by-side. See prices, ratings, amenities, and more—all in one place.